STOA Infra & Energy is pleased to announce its adoption of the Operating Principles for Impact Management (“The Principles”) of the International Finance Corporation (a member of the World Bank Group). The Principles provide new market standards for impact investing in which investors seek to generate positive impact for society alongside financial returns in a disciplined and transparent way.

Practically speaking, the 9 principles aim to go beyond ESG risk management with a robust and transparent method in order to ensure a serious inclusion of investments’ impacts in our process.

Notably, the signing parties are committed to submitting an independently verified annual report on their impact management system alignement vis-à-vis “The Principles”.

Beyond its systematic analysis of the E&S and Climate stakes, STOA now relies on a robust and transparent management system that integrates investments’ impacts measurement at every step of the investment process.

By adopting the Operating Principles for Impact Management, STOA reiterates its own commitment to the reconciliation of value creation and sustainability and to the generation of positive impacts, such as job creation and climate mitigation, in the developing countries.

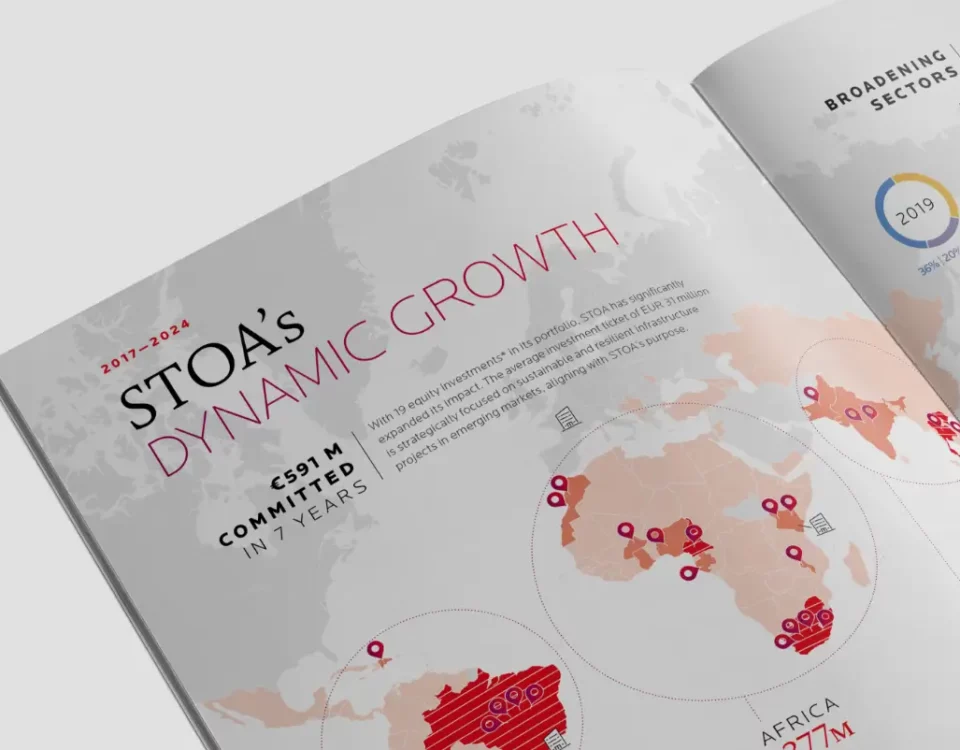

STOA has a mandate to invest equity tickets from 10 to 50 million Euros in the infrastructure and energy sectors in developing countries with a target of 50% of funds invested in Africa and 30% in climate co-benefits projects. STOA and its partners shares the same vision of progress, based on co-construction, entrepreneurship and a focus on the development of projects which are essential for the wellness of population and countries’ growth.

“We believe there is now potential to bring impact investing into mainstream,” said IFC CEO Philippe Le Houérou. “Our ambitions are very high – we want much more money managed for impact because there’s no time to lose to deliver on the billions to trillions agenda.”

Charles-Henri Malécot, CEO of STOA, underlined the benefits of the Principles and the consistency of this new commitment regarding STOA’s ambitions: “The Principles bring greater transparency, credibility, and discipline to the impact investing market. We are convinced that impact investments have the potential to make a significant contribution to important outcomes and we define strategic impact objectives to achieve positive and measurable social and environmental effects, which are aligned with the Sustainable Development Goals (SDGs).”