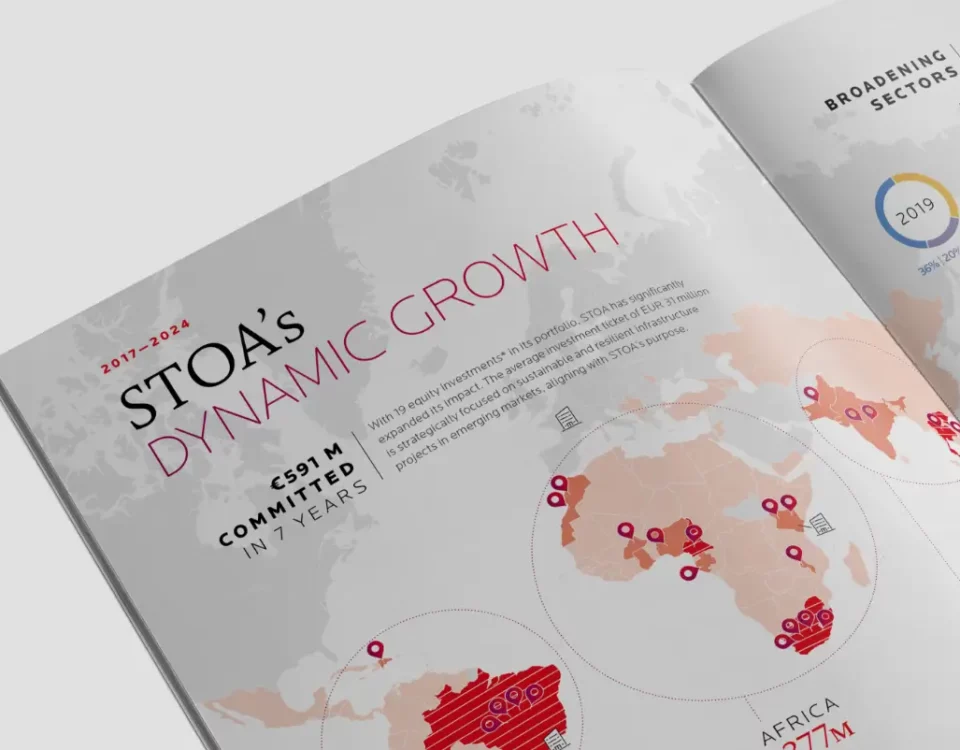

Cape Town/Johannesburg/Paris, November, 2020 – African Infrastructure Investment Managers (AIIM), one of Africa’s largest infrastructure-focused private equity fund managers, has acquired a minority equity stake in MetroFibre Networx (Pty) Ltd, a South African open access fibre network operator, through the newly incorporated Digital Infrastructure Investment Holdings platform. AIIM’s investment forms part of a ZAR1.5 billion equity funding round to support Metrofibre’s capital expansion plan which exceeds ZAR 3 billion over the coming three years and will further enhance the company’s empowerment positioning. Existing shareholder STOA, a foreign investment vehicle based in France, is providing incremental funding as part of the transaction together with new investment by the founders of the South African Housing & Infrastructure Fund (SAHIF), Rali Mampeule and Kameel Keshav. The transaction sees AIIM, STOA and SAHIF partner with remaining shareholders of MetroFibre, including Sanlam Private Equity and African Rainbow Capital.

Cape Town/Johannesburg/Paris, November, 2020 – African Infrastructure Investment Managers (AIIM), one of Africa’s largest infrastructure-focused private equity fund managers, has acquired a minority equity stake in MetroFibre Networx (Pty) Ltd, a South African open access fibre network operator, through the newly incorporated Digital Infrastructure Investment Holdings platform. AIIM’s investment forms part of a ZAR1.5 billion equity funding round to support Metrofibre’s capital expansion plan which exceeds ZAR 3 billion over the coming three years and will further enhance the company’s empowerment positioning. Existing shareholder STOA, a foreign investment vehicle based in France, is providing incremental funding as part of the transaction together with new investment by the founders of the South African Housing & Infrastructure Fund (SAHIF), Rali Mampeule and Kameel Keshav. The transaction sees AIIM, STOA and SAHIF partner with remaining shareholders of MetroFibre, including Sanlam Private Equity and African Rainbow Capital.

MetroFibre, which was launched in 2010, is a high-growth player in South Africa’s Fibre-To-The-Home (“FTTH”) and Fibre-To-The-Business (“FTTB”) markets. Over the last 10 years, MetroFibre has expanded its service offering to both residential and corporate customers in line with its strategic objective of being a diversified operator. MetroFibre owns and manages its core network which is a globally compliant Carrier Ethernet 2.0 open access network.

Commenting on the transaction, Marie-Laure Mazaud, Deputy CEO of STOA, noted: “This transaction materializes the company’s efforts combined with the active support and expertise of STOA investment team in managing, alongside the management, the fund-raising process to ensure qualitative, fruitful and solution-oriented interactions between all the parties involved. STOA’s further equity investment in MetroFibre as part of this new funding round confirms our long-term commitment to the deployment of affordable, reliable and fast connectivity in Africa.” Charles-Henri Malecot, STOA’s CEO, added: “The successful closing of this capital raise signals our full confidence in the company and its management in the midst of the COVID-19 crisis and demonstrates the strong resilience of the fibre sub-sector and the growing market momentum in both the FTTH and FTTB segments in the African continent.”

Commenting on the transaction, Ed Stumpf, AIIM’s Investment Director, noted: “This investment provides AIIM with an attractive foothold in the digital infrastructure market in South Africa. Despite material investment in recent years, AIIM continues to see a significant deficit in last-mile fibre connectivity across many parts of the country. Fibre networks underpin the growing demand for high speed, low latency home internet and are crucial to facilitate the accelerating digital migration caused by recent global lockdowns.”

“Through this investment, AIIM has additionally prioritised the strengthening of MetroFibre’s empowerment credentials. Rali Mampeule and Kameel Keshav – CEO and CFO of the South African Housing & Infrastructure Fund – both of whom bring years of experience in the affordable housing sector – have been introduced as strategic empowerment partners through the newly incorporated Digital Infrastructure Consortium Proprietary Limited platform and share our growth agenda and excitement in enhancing connectivity for all South Africans.”

SAHIF CEO, Rali Mampeule, noted: “Our key investment focus is to support synergistic opportunities in property sector-related impact development. As a business we recognise the long-term impact that technological advancement can have for households and businesses. Diminishing the barriers to technological advancement adoption for households is key to local development impact in the property sector.”

AIIM is a member of Old Mutual Alternative Investments (OMAI) and has been investing in the African infrastructure sector since 2000, with a track record extending across seven African infrastructure funds. AIIM’s investment, through its IDEAS Managed and AIIF3 Funds, will support MetroFibre’s plans to densify its network in existing areas and expand its offering to an additional 300,000 residential homes across cities and towns nationwide over the next three years.

Existing shareholder STOA, a French investment holding with a capital base of EUR600 million backed by Caisse des Dépôts (CDC) and the Agence Française de Développement (AFD), earmarked for investments in equity and quasi equity in emerging countries in the telecommunications, power and transportation sectors, also followed its equity rights and participated to this new capital raise in MetroFibre.

MetroFibre CEO, Steve Booysen, added: “The successful capital raise will enable MetroFibre to continue with its growth strategy and explore acquisition opportunities, connecting customers with the global economy through a reliable and fast connection. In addition to our organic growth plan, the successful capital raise ensures that MetroFibre is well placed to play a leading role in the sector’s consolidation process, given our strong leadership and operational teams, as well as significant shareholders of reference.”