![]()

![]()

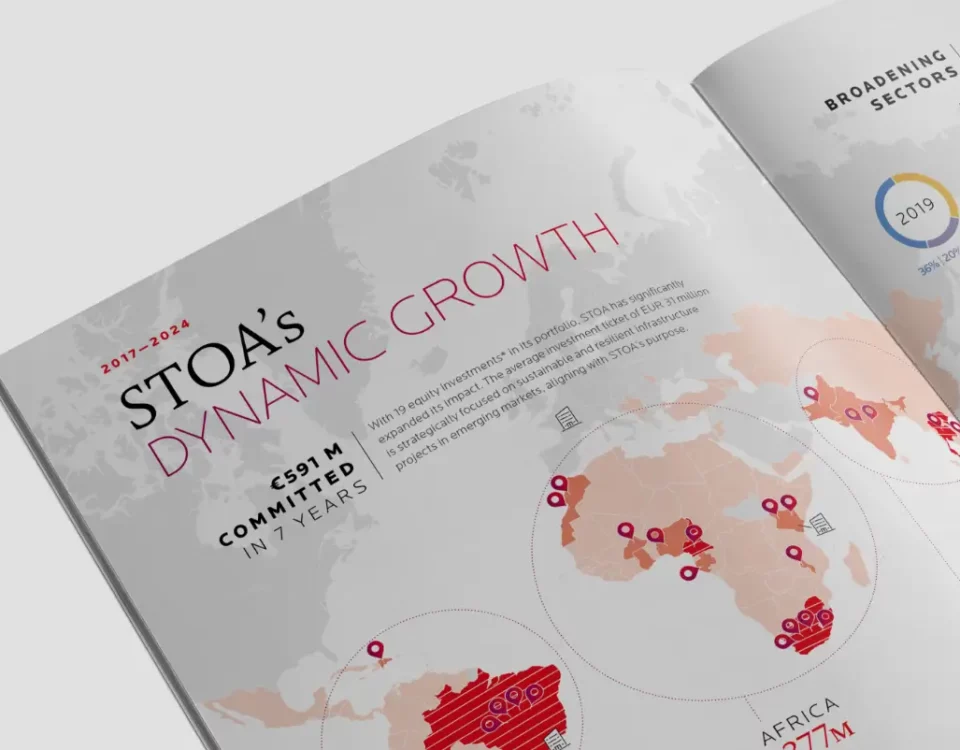

Casablanca, 19 May 2025 – STOA and Africa50 Infrastructure Acceleration Fund (Africa50 IAF) today signed a share purchase agreement for the acquisition of a 49% stake in Mass Céréales al Maghreb from A.P. Moller Capital’s Africa Infrastructure Fund I. The transaction will be completed after approval from the Moroccan competition authority. Holmarcom Group retains 51% of the capital. The purpose of the transaction is to support the development of grain handling infrastructure and accelerate the company’s pan-African expansion.

Since its establishment in 2008, Mass Céréales al Maghreb has become a key player in Morocco’s grain port logistics. With its two terminals located in Casablanca and Jorf Lasfar, the company has handled over 55 million tons of bulk cereals, representing nearly half of Morocco’s imports during this period. This strategic positioning highlights its expertise in managing port infrastructure that is essential to the country’s supply chain.

2024 marked a decisive milestone in Mass Céréales al Maghreb’s regional expansion strategy with the inauguration of a new handling and storage facility at the Port of Bargny-Sendou, Senegal. This first establishment outside Morocco meets the growing demand for integrated logistics solutions in the West African region, where the need for cereal imports is steadily increasing.

A.P. Moller Capital, which is divesting an asset from its first fund, paves the way for the joint entry of STOA, and Africa50 IAF, to partner with the Holmarcom Group, the historic and majority shareholder of Mass Céréales al Maghreb. This transaction reflects a shared ambition for the development of strategic infrastructure in Africa, with the aim of creating new cereal terminals in several ports across the continent to contribute to food security and the creation of sustainable jobs.

Hafid Debbarh, CEO of Mass Céréales Al Maghreb, said “I would like to express our appreciation to A.P. Moller Capital for their support and trust over the past four and a half years, which has significantly contributed to the development of our company. We warmly welcome STOA and Africa50 IAF as new shareholders. Their recognized expertise and strong commitment to sustainable development in Africa will enhance our ability to strengthen our position and support our growth across the continent. We look forward to a fruitful collaboration that will enable us to expand our operations and further contribute to food security and economic development in the region. Together, we are well-positioned to meet the evolving needs of the African market with resilience and innovation.”

Marie-Laure Mazaud, CEO of STOA, states: “We are very pleased to join the capital of Mass Céréales al Maghreb. This transaction reflects our commitment to co-building sustainable infrastructure solutions that address the growing needs of the continent to secure cereals flows, create jobs and develop a true expertise in the logistics sector. In collaboration with Holmarcom and Africa50 IAF, we are confident that we can accelerate the transformation of the grain logistics chain and streamline port traffic, while directly contributing to food security and the economic development of the region.”

Opuiyo Oforiokuma, Senior Partner of Africa50 Infrastructure Acceleration Fund, said “Africa50 IAF is pleased to support Mass Céréales al Maghreb’s next phase of growth alongside Holmarcom and STOA. This investment reflects our conviction that strategic logistics infrastructure, particularly in the agri-food value chain, is essential to unlocking Africa’s potential. By expanding cereal terminal capacity across the continent, we are not only strengthening food security but also fostering regional trade integration and sustainable job creation. This partnership exemplifies how catalytic capital can accelerate commercially viable infrastructure that delivers real development impact.”

Joe Nielsen, Partner at A.P. Moller Capital, states: “We are grateful for the cooperation and support of Holmarcom throughout this successful partnership. Together, and with the superior management team and employees of Mass Céréales, we have taken the company to the next level on its strategic growth journey. This partnership exemplifies A.P. Moller Capital’s purpose of investing in critical port infrastructure to support economic development and job creation. Since our acquisition in 2020, Mass Céréales has invested considerably to expand its operational capacity in the ports of Casablanca and Jorf Lasfar; and has expanded and improved its international operation. We are pleased to welcome STOA and Africa50 IAF to support the next phase of Mass Céréales’ development and we are confident that they will be excellent future partners.”