Belem, Brazil, November 14, 2025 – During the 30th Conference of the Parties (COP30) to the UN Framework Convention on Climate Change, Caisse des Dépôts (CDC), Agence française de développement (AFD), STOA and 151 Bis Partners (the “Parties”) reasserted their intend to advance climate action by joining forces to launch an investment activity dedicated to climate transition and resilient infrastructure projects primarily in Africa and Latin America.

- This initiative reflects the Parties’ shared ambition to accelerate sustainable development and support the objectives of the 2015 Paris Agreement.

- CDC and AFD, through STOA’s balance sheet, express their willingness to encourage a new investment activity dedicated to climate transition and resilient infrastructures in emerging and developing countries in Africa and Latin America.

- With the clear expectation from the Parties that this shall mobilize funds from other professional investors, 151 Bis Partners, CDC and AFD will collaborate to establish STOA Asset Management S.A.S., a portfolio management company currently seeking approval from the Autorité des marchés financiers (AMF), in order to launch an investment fund.

- The European Investment Bank (EIB), through its development arm EIB Global, has also recently approved a financial support to the new fund initiative.

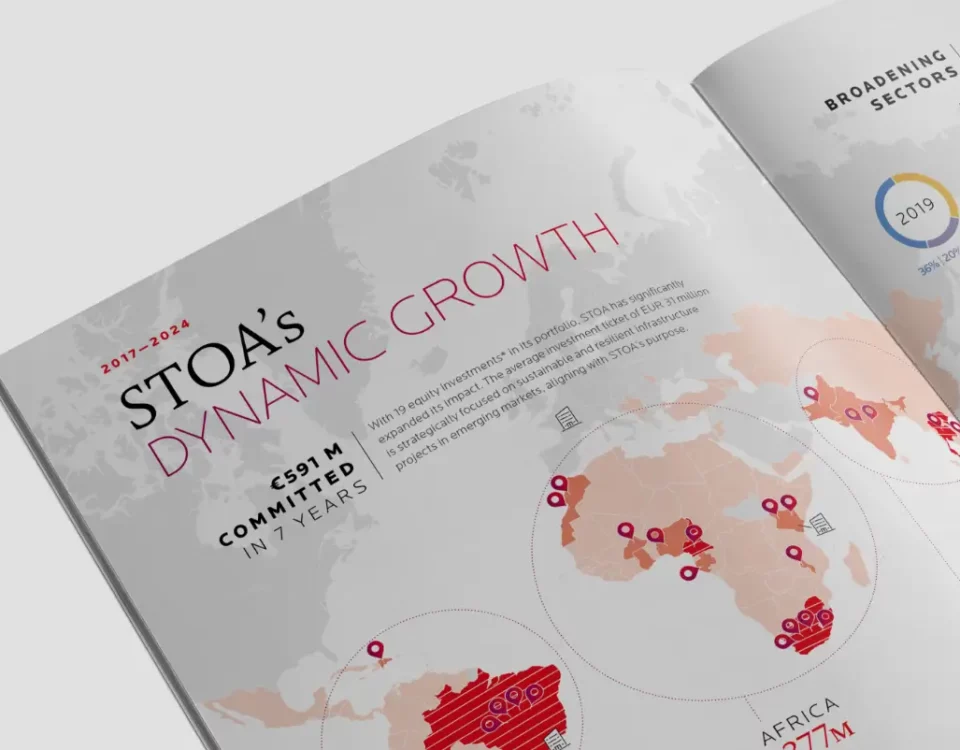

This strategic partnership builds on STOA’s proven track record in emerging markets, where it has invested EUR 633 million across 21 transactions in renewable energy and urban transportation sectors in more than 10 countries over the past 8 years. The new platform aims to scale these efforts, focusing on projects that foster climate resilience and sustainable infrastructure.

The team intends to rely on its strong expertise and extensive network to bring new investments to this initiative. Strict ESG standards – aligned with the 2015 Paris Agreement and the IFC Performance Standards – will be applied in the implementation of such strategy.

Executive Quotes

Olivier Sichel, CEO of Caisse des Dépôts: “CDC is proud to build up on STOA’s achievements and join forces with leading institutions to mobilize capital for projects that align with the 2015 Paris Agreement. The creation of STOA Asset Management is the good lever to foster innovation and resilience on infrastructure projects.”

Rémy Rioux, CEO of Agence française de développement: “AFD supported the creation of STOA in 2017 as part of our commitment to sustainable infrastructures. Today, we are proud to accompany STOA into its next chapter, scaling up its impact and reinforcing its role as a key player in climate transition and resilient infrastructure.”

Marie-Laure Mazaud, CEO of STOA: “This agreement marks a pivotal moment for STOA and our partners. By pooling our field expertise, team spirit and resources with investors sharing common goals and DNA, we aim to accelerate investments that deliver tangible climate benefits and long-term resilience for communities in Africa and Latin America.”

Mathieu Lebègue, Representative of 151 Bis Partners: “Our team is honored to contribute to this ambitious initiative. We believe that combining institutional strength with entrepreneurial agility will create a powerful tool for climate-positive investments.”