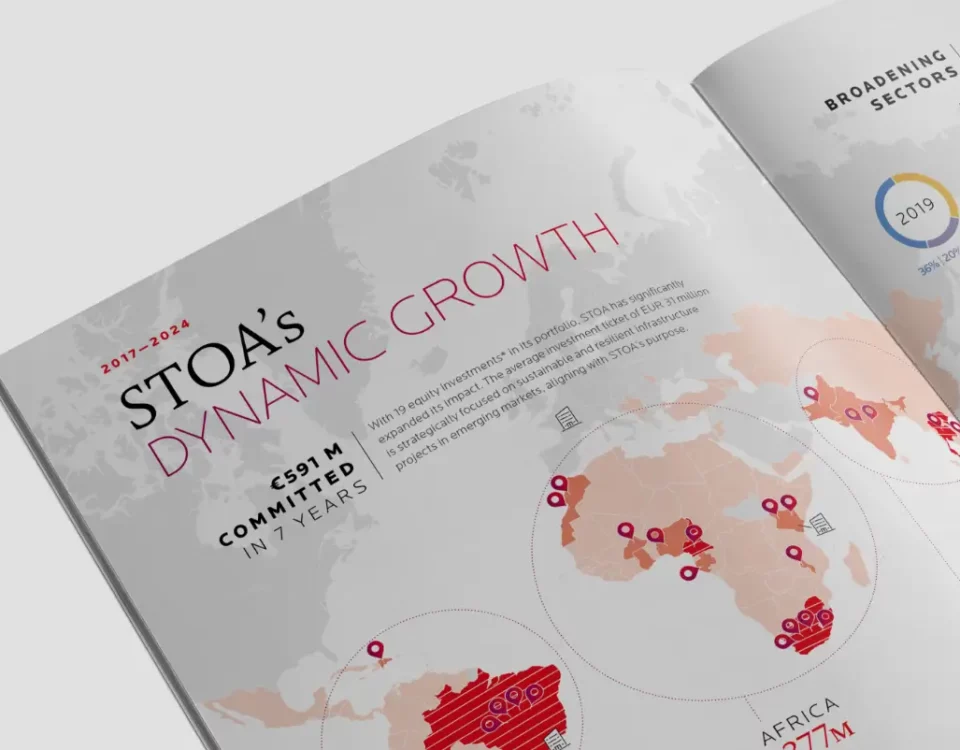

Zurich, 21 July 2025 – Candi Solar, a leading distributed energy company simplifying clean power for businesses in emerging markets, has secured USD 24 million in fresh funding from its existing investors. The raise includes a USD 20 million convertible loan from Norfund and STOA, alongside a USD 4 million top-up to its existing mezzanine facility with the Energy Entrepreneurs Growth Fund (EEGF). This round brings Candi’s total capital raised to over $140 million, reinforcing the company’s position as a long-term energy partner in some of the world’s most carbon-intensive energy markets.

In 2024, Candi was ranked 3rd among all rooftop solar developers in India, and its expansion into larger-scale open-access projects further strengthens its position as a full-spectrum energy provider for commercial and industrial clients.

Candi Solar has built a model that blends the capital expertise of international investors with the local know-how of an on-the-ground energy partner. Over the past 12 months alone, the company has added more than 60 MW to its active portfolio, including a landmark 16.5 MW open-access solar project in Gujarat, India. Its total contracted capacity now stands at 166 MW, with active operations in 22 Indian states and union territories, and eight provinces in South Africa.

This growth hasn’t just been about building more projects – it’s about redefining how solar works for businesses. As more companies adopt solar, a new challenge has emerged: making sure those systems actually deliver over time.

Performance Is the Product

Candi’s performance-based model focuses on reliable long-term partnerships where revenue is tied to results – not just installation. With advanced monitoring, intelligent upgrades, and hands-on system management, clients gain the confidence that their solar is delivering consistent value without the operational burden.

To meet this need, Candi has launched a suite of offerings tailored for businesses with existing solar:

- Solar Refi – a refinancing solution that unlocks capital from current assets while transferring performance oversight to Candi.

- Solar ProtectPlus – a fully managed solution where Candi takes over operations, maintenance, and monitoring, with output linked to actual system performance.

- Solar Max – a technical and commercial upgrade service for systems that are underperforming or poorly maintained.

Positioned for the Next Phase of Growth

“This round enables us to deepen our presence in core markets, expand our product suite, and continue to attract world-class talent,” said Fabio Eucalipto, Co-founder and Director at Candi. “But more than that, it validates a long-term approach in a space often dominated by short- term thinking. This raise reflects something bigger than project growth – it’s about building the financial and operational structures that make clean energy investable at scale in emerging markets. Solar alone doesn’t solve the problem. It’s how you fund it, run it, and prove it works over time.”

“Since Norfund’s initial investment in Candi last year, the company has doubled its operational portfolio and is set to continue on this impressive growth trajectory. This is a testament to the success of Candi’s business model and the need for the innovative product solutions they provide to commercial and industrial clients in India and South Africa. These two markets face a rapidly growing demand for energy financing, and Candi’s offering contributes to these needs while avoiding large scale emissions. We appreciate the strong collaboration we continue to have with both management and other shareholders, and look forward to following the company’s continued success,” said Sofie Kamsvåg, Investment Manager in Norfund.

Antoine Durand, Investment Director at STOA Infra & Energy, highlighted the importance of this renewed investment in Candi Solar, stating: “It reinforces our commitment to expanding access to reliable and clean energy. By supporting Candi Solar’s innovative approach, we enable small and medium-sized businesses to overcome unreliable grids and reduce carbon- intensive power use. We believe distributed energy solutions like Candi’s are key to accelerating the energy transition in India and South Africa, delivering tangible economic and environmental benefits for local communities. As a shareholder since 2022, we value the trust and alignment with Candi’s management and co-investors, and are proud to stand alongside them as the company scales its impact.”

Mark van Doesburgh, Deputy Head Direct Investments at EEGF/Triple Jump: “We are proud to deepen our partnership with Candi by increasing our mezzanine facility to USD 9.7 million in total, which will finance growth and contribute to unlocking additional funding. As an existing shareholder, EEGF is committed to supporting Candi’s continued growth and innovation in distributed solar. The company plays an important role in the renewable energy transition for SMEs and other businesses in the markets it operates in. Candi’s performance-driven model and strong execution are delivering real impact-empowering businesses with reliable, cost- efficient and clean energy while reducing emissions.”

Looking Ahead: Series D Preparation

Riding the momentum of this latest raise, Candi is preparing for a high double-digit-million Series D round in 2026. The planned raise will support broader reach across its core markets and fund continued innovation in how clean energy is delivered and scaled in emerging markets.