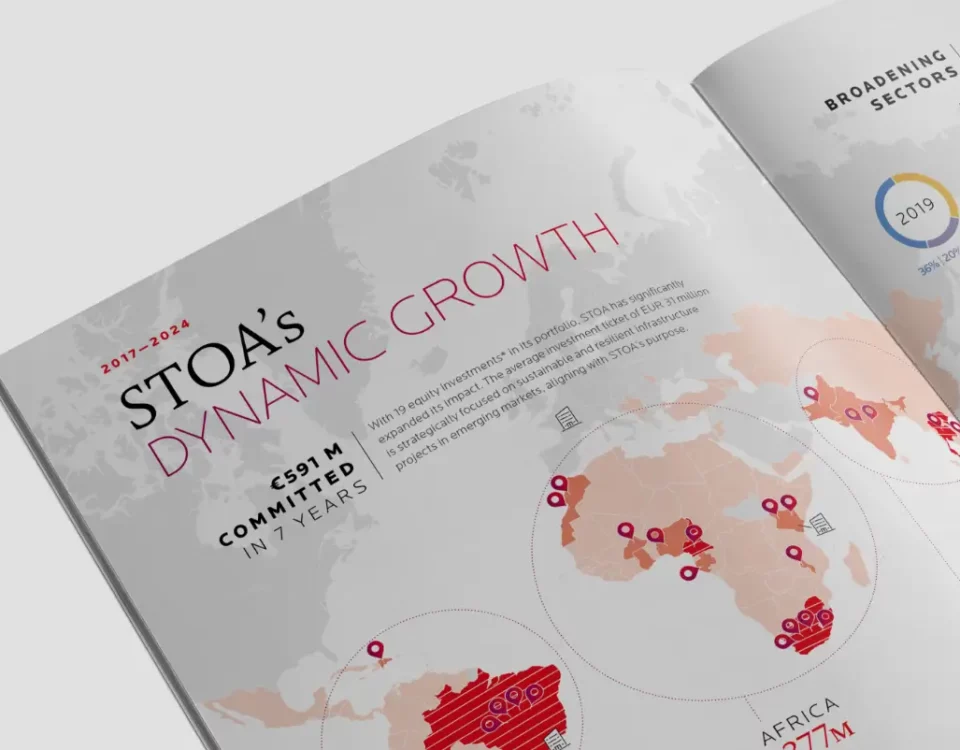

15 April 2025 — GreenYellow, a global leader in decentralized energy transition, STOA, a French impact investor specializing in infrastructure projects, and DEG, the German development finance institution, proudly announce the financial close of a 189 MWp asset platform (YieldCo) in Singapore, dedicated to operating self-consumption solar assets in Vietnam and Thailand. This landmark transaction represents a decisive step in the region’s energy transition, demonstrating the commitment of all three partners to accelerating the deployment of decentralized solar power plants in Southeast Asia, contributing to the competitive decarbonation of these fast-growing economies.

A strategic partnership for lasting impact

GreenYellow remains the majority industrial shareholder of the asset platform, ensuring its operational expertise and strategic leadership. The entry of DEG and STOA marks the beginning of a long-term partnership, bringing strengthened financial stability, recognized expertise in ESG standards, and a strong commitment to impact-driven investments. Their contribution will accelerate the expansion of the asset portfolio beyond the initial 189 MWp, delivering tangible benefits to local corporates: reduced energy costs, increased energy autonomy, and lower CO₂ emissions.

This closing marks a key milestone in the maturity of GreenYellow Asia, strengthening its financial independence. It enables the GreenYellow Group to optimize its expansion in Asia while continuing its European market ambitions. The platform is expected to reach 400 MWp by the end of 2026.

The shareholding structure is as follows: GreenYellow holds 51% of the capital, while STOA and DEG jointly own 49%, respectively: 29.7% for STOA and 19.3% for DEG.

A growth driver for self-consumption solar projects

This new investment company will serve as a growth catalyst for future acquisitions and investments in self-consumption solar projects in Vietnam and Thailand. By combining GreenYellow’s industrial expertise with STOA and DEG’s development financing capabilities, the asset platform aims to strengthen its portfolio and accelerate energy transition efforts in the region, further consolidating its position as a leader in Southeast Asia’s photovoltaic energy sector.

Strategic expansion in Southeast Asia

Franck Gluck, CEO of GreenYellow Asia, stated: “This transaction enables GreenYellow Asia to continue its expansion in high-growth regions such as Vietnam and Thailand, in line with its long-term strategy of promoting energy transition in both mature and emerging economies.”

Marie-Laure Mazaud, CEO of STOA, added: “This new and fourth investment in the C&I sector reaffirms STOA’s commitment to distributed energy. We are very pleased to collaborate with GreenYellow and DEG and contribute to the expansion of the asset platform, providing affordable green electricity to an ever-growing number of clients. In GreenYellow, we have found not only a market leader with extensive experience and a high-quality asset portfolio but also a partner that shares our values and aligns with our purpose of financing strategic renewable energy projects, driving the decarbonation of the energy mix in emerging economies.”

Monika Beck, Member of the DEG-Management Board, commented: “We look very much forward to our collaboration with GreenYellow and STOA on the solar energy projects in Thailand and Vietnam. DEG has a strategic focus on sustainable investments and high impact. Therefore, our direct equity investment in a sustainable energy platform that is supporting private companies in their transformation process to decarbonize their energy supply fits in very well.”

Trusted partners for a successful transaction

The success of this operation was made possible by the expertise of all advisors involved, including: Astris Finance as financial advisor to GreenYellow, Clifford Chance as legal counsel to GreenYellow, and Mayer Brown as legal counsel to DEG and STOA.